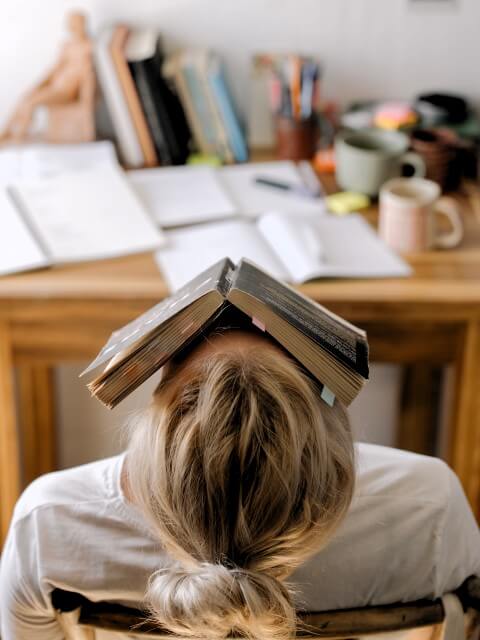

Mess After Divorce: It’s possible for you to love your life again.

It’s a tricky, devious, exhausting struggle, this whole getting-over-a-relationship thing. And if you have been married, you know there is a lot more at stake than just a romantic hit-and-run. Marriage means you were vested in something bigger than just “two people in love.” So, if your life is a mess after divorce, it’s no wonder.

It’s a tricky, devious, exhausting struggle, this whole getting-over-a-relationship thing. And if you have been married, you know there is a lot more at stake than just a romantic hit-and-run. Marriage means you were vested in something bigger than just “two people in love.” So, if your life is a mess after divorce, it’s no wonder.

Think about what it’s like to pack up and move from a house you have lived in for 10, 20, 30 years. Now imagine the task as an effort to downsize.

Everything that was once neatly in its place (on cleaning day, anyway) is now…well…everywhere. Essentials, non-essentials, mementos, family heirlooms, favorites-for-no-good-reason. It’s all unearthed, waiting for a decision to be made on its destiny.

Your home is a mess. Your life is a mess. After divorce, this metaphor comes to life in every area of your existence. You don’t feel as if you are “just moving” (or that they are just moving) — you feel as if you have been foreclosed on.